Participate in Life Happens’ Facebook Chat for Life Insurance Awareness Month

Join Life Happens for a Facebook Chat during Life Insurance Awareness Month this September. We’ll discuss all things life insurance and living benefits! Date: Thursday, September 14, from 1 to 2 p.m. ET Where: Join us on Facebook using your personal handle or your...

Featured

Participate in Life Happens’ Facebook Chat for Life Insurance Awareness Month

Join Life Happens for a Facebook Chat during Life Insurance Awareness Month this September. We’ll discuss all things life insurance and living benefits!

Recent Posts

At Life Happens, our nonprofit mission is always at the center of what we do: to give you unbiased information to help you make smart insurance choices to protect your loved ones. This #GivingTuesday, we’re shining a light on this mission by sharing a story that ...

As a small-business owner or partner, you may wonder what would happen to your business should anything happen to you. How would your family cope with the loss of income? What about your employees and their families? What happens when a business has debts that are ...

Among the most heart-wrenching pictures during the first months of the pandemic were images of the impact it had on our most vulnerable populations: our elders. Birthday parties through windows, the isolation of lockdowns – many people wished they were living in ...

Today, women are more concerned than ever about their financial vulnerabilities. Financial advisor Meredith Moore, CLTC, LUTCF, explains how life insurance and related products can help women offset financial risk, maximize opportunity, and plan for the ...

While Life Insurance Awareness Month may be coming to a close, the need for coverage is year-round. If you haven’t taken that step to get life insurance yet, right now is the best time to get started.

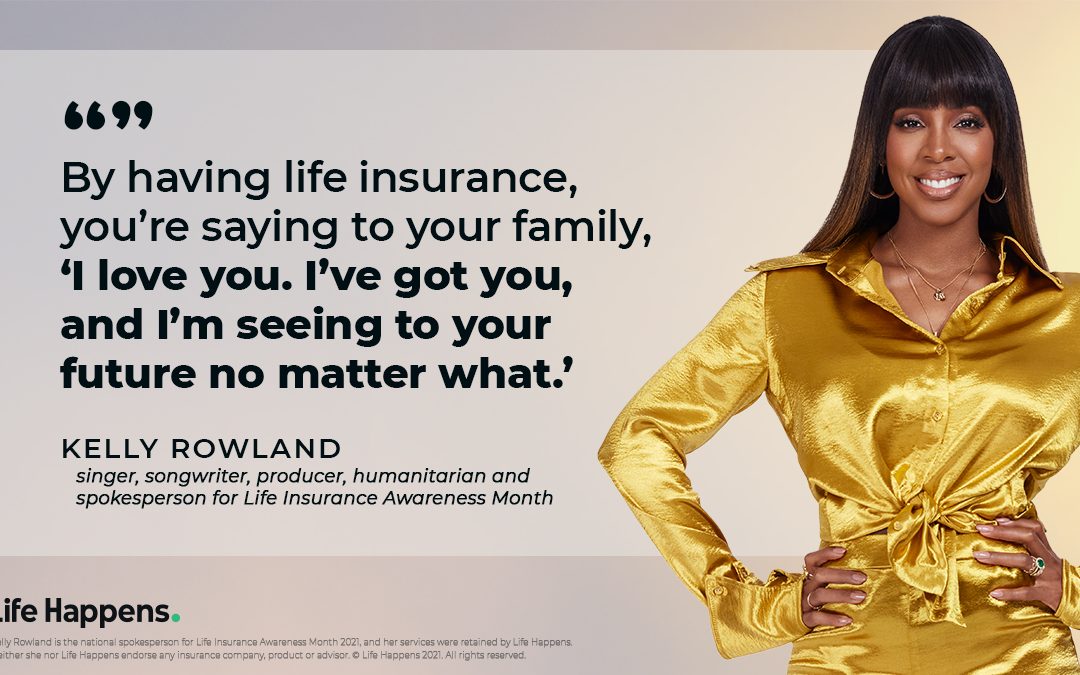

Award-winning singer, songwriter, producer and humanitarian ...

Despite the devastation the pandemic has caused over the past year, perhaps there is a silver lining to be found in COVID-19’s dark clouds. Mortality and financial wellness have been brought into sharp focus, resulting in more people seeking life insurance ...

More Posts

Most Americans agree that preparing financially for life’s unknowns is a way to show that you care. In fact, almost 2 in 3 think that having life insurance is key to taking care of their family financially. These are just some of the findings from the “2019 Insure ...

Let’s think about this: You’ve earned the majority of what you’ll ever earn over the past 40 years. You should have accumulated enough assets to retire and live happily ever after, right?

The ups and downs of the financial markets, however, have been an eye opener ...

Join Life Happens and LIMRA representatives as we moderate a Twitter Chat focused on life insurance and how it offers protection and peace of mind. The chat is just a part of our activities during February’s Insure Your Love Month. There will be plenty of activity ...

If you’re like me, your social-media feeds are jammed with headlines about getting “healthy and fit” in the new year. Of course, they’re referring to diet and exercise and common resolutions to drop pounds and work out more often.

But it’s just as important to be ...

You’re probably already aware that a parent with a job outside the house most likely needs life insurance to protect their loved ones in case something were to happen. But it’s not just breadwinners who need coverage—stay-at-home parents do, too. Here are nine ...

On #GivingTuesday, we wanted to share a story that highlights how important your giving can be in changing a life.

Prentiss Bullard says one of the most important values his father instilled in him was education. “It was my dad’s dream for me to go to college, ...

It’s Long-Term Care Insurance Awareness Month—and for good reason. Many people don’t know exactly what this type of insurance is or what kind of benefits it provides. But don’t worry if you fall into the “I don’t know” category, because as part of our mission as a ...

Are you confused about life insurance? I don’t blame you. When I first started writing about finances more than a decade ago, my understanding of life insurance was limited.

I knew about life insurance because it was offered through my employer, and I thought a ...

Each year Life Happens and LIMRA join forces on the Insurance Barometer Study to get the latest and greatest information about what consumers are thinking when it comes to the financial concerns that are bothering them the most as well as what types of insurance ...

So many people get down on Millennials, telling them they are doing just about everything wrong. That's why when Life Happens and LIMRA did a joint Twitter chat for Life Insurance Awareness Month #LIAM18Chats, people had a lot of good insight and some great advice ...

It's Life Insurance Awareness Month! And we will just step aside to let our spokesperson Danica Patrick tell you why life insurance has always been important to her—and why it should be for you, too.If you think you may need life insurance, or more of it, spend a ...

Join Life Happens and LIMRA representatives as we moderate a Twitter Chat focused on findings from the 2018 Insurance Barometer Study. There will be plenty of activity from the media, insurance companies, agents and consumers. We hope the chat helps promote life ...