5 Advantages of Combining Annuities and Life Insurance for Retirement

Preparing for your retirement needs careful planning to ensure you get the right benefits after years of hard work. Combining annuities and life insurance can be one way to achieve a comprehensive plan that sets you on the right track for a relaxing retirement. You...

Featured

5 Advantages of Combining Annuities and Life Insurance for Retirement

Using both annuities and life insurance as part of your retirement strategy can give you income during your retired years, as well as a death benefit after you die.

Recent Posts

Women’s History Month is a time to reflect on women’s many contributions to American life. It’s also a time to gauge how far women have come in achieving true equality.

Many people are aware of the gender pay gap of women earning on average only 82 cents to every ...

Financial planner Delvin Joyce has worked hard to dispel myths that the Black community holds about life insurance.

The founder and president of Prosperity Wealth Group in Charlotte, N.C., regularly helps members of his local community get coverage. Here are the ...

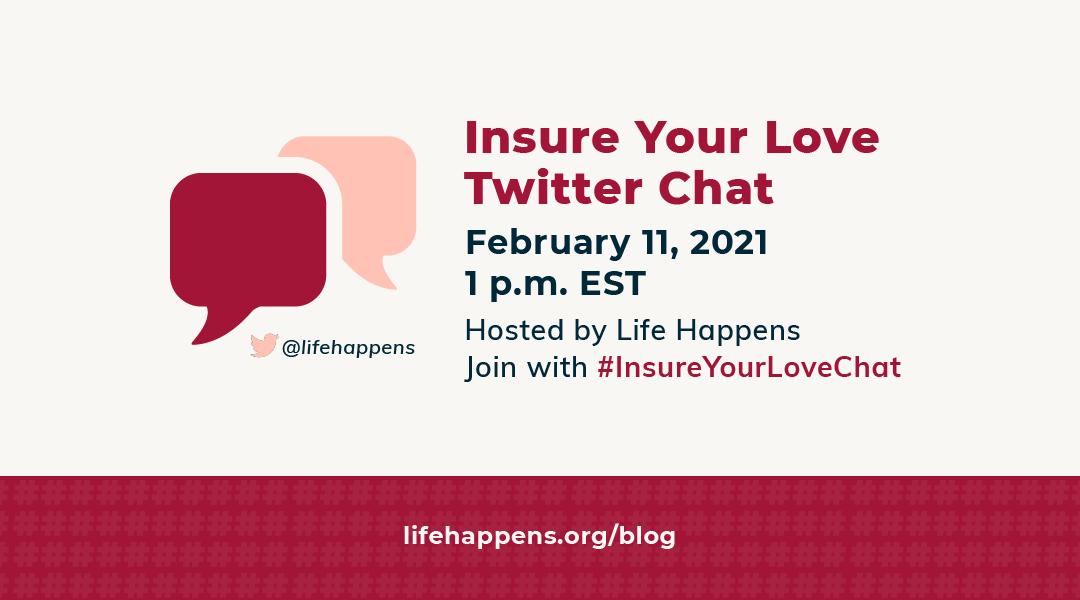

Join Life Happens for a Twitter Chat during Insure Your Love month this February. We’ll discuss new data that shows Americans are shifting their priorities and focusing on financial security in response to COVID-19.

The pandemic has helped many of us appreciate ...

Many people wonder if single people need life insurance.

It’s easy to believe the answer is “no.” After all, the main purpose of life insurance is to provide cash to your family if you were to pass away. So it seems logical to think you don’t need life insurance ...

About half of all Americans make New Year’s resolutions. Along with exercising more and eating better, many people aim to get a better handle on their finances.

If you’re in that camp, we’re here to help. Here are some surefire steps to create a more financially ...

Many people falsely believe that life insurance for diabetics doesn’t exist. In reality, there are quite a few life insurance options for the 34.2 million Americans who have diabetes.

While diabetes remains a health challenge for many, it is still very possible to ...

More Posts

Few people are prepared to handle the financial burden of long-term health care. In fact, many people have a false sense of security when it comes to long-term care. Let's separate fact from fiction:

“Medicare and my Medicare supplement policy will cover ...

Being catapulted into the adult world is a shock to the system, regardless of how prepared you think you are. And these days, it’s more complicated than ever, with internet access and mobile devices being must-have utilities and navigating tax forms when they ...

One of the perks of having a full-time job with a good company is the benefits package that comes with it. Often, those benefits include life insurance coverage, which is great. And everyone who can get life insurance at work should definitely take it, as there ...

I lost my father to lung cancer when I was 7 years old. Without his steady income and also without adequate life insurance covering his loss, my mother had to raise my brother, who was 10, my sister, who was 9, and me by herself solely on Social Security and ...

With all the expenses of everyday living, it’s tempting to think of insurance as just another cost. What’s harder to see is the potential cost of not buying insurance—or what’s known as “self-insuring”—and the hidden bargain of coverage.

The Important vs. the ...

Your life insurance needs will ebb and flow throughout your lifetime. Buying a term policy early in your career or taking a basic employer-issued life insurance policy is a common course of action.

However, deciding how much and what type of life insurance you ...

One of the most harrowing experiences I’ve ever had was during the sixth month of my pregnancy. My husband was out late, hadn’t called, and I was, of course, angry at his thoughtlessness. But this very evening, he had misjudged a bend in a rural, mountain road—and ...

Imagine one morning waking up to find that your mother unexpectedly passed away during the middle of the night. Now imagine reliving that horrible experience again 14 months later when your father dies from a terminal illness. I wouldn’t wish that on anyone, but ...

We spend a lot of time talking about how couples, families and businesses can protect their financial futures with life insurance. But what about if you are single—do you need life insurance, too?

There are those people who have no children, no one depending on ...

As a parent, perhaps you’ve been able to check the critical financial boxes for your family. You’ve established emergency funds, secured life and disability insurance, and are on track with your retirement goals. You may wonder, is there anything else I could be ...

Each year the government (the USDA to be exact) publishes how much it costs to raise a child to 18. The number is staggering. It's more money than most of us can imagine coming up with, which is why life insurance is so important. You can cover that ...

Let’s face it. Most people put off buying life insurance for any number of reasons—if they even understand it Take a look at this list—do any of them sound like you?

1. It’s too expensive. In the ever-burgeoning budget of a young family, things like day care and ...