Upgrading Your Life Insurance: Is Switching from Term to Perm Right for You?

As life happens and your needs change, you may find yourself questioning whether your current life insurance coverage is the best fit for you. If you currently have a term life insurance policy but are considering switching to permanent life insurance coverage, you...

Featured

Upgrading Your Life Insurance: Is Switching from Term to Perm Right for You?

If you currently have a term life insurance policy, you may be wondering if it’s possible to make the switch to permanent life insurance. The good news is you can, but there are some important factors to consider first.

Recent Posts

I’m going to let you in on a secret: You don’t have to be a millionaire to give back like one. Life insurance is an affordable way to leave a large, lasting legacy to a charity, school or religious organization. If you currently donate sporadically or even commit ...

Over the past two years, COVID-19 has killed Black Americans at a faster rate than any other demographic. And yet, there are still at least 20 million individuals in the Black community without adequate life insurance coverage, according to the 2021 Insurance ...

Did you know that how you prefer to receive love can reveal a lot about how you view your finances? According to the recent survey “For Love and Money” by Life Happens, each of the five love languages has a corresponding style of showing love financially.

So, ...

Bringing up life insurance with your family and loved ones is not fun or easy. It makes us confront our “favorite” topics: death, finances, taxes, estate planning, debts, health care. But getting life insurance is an expression of love that goes beyond words. It ...

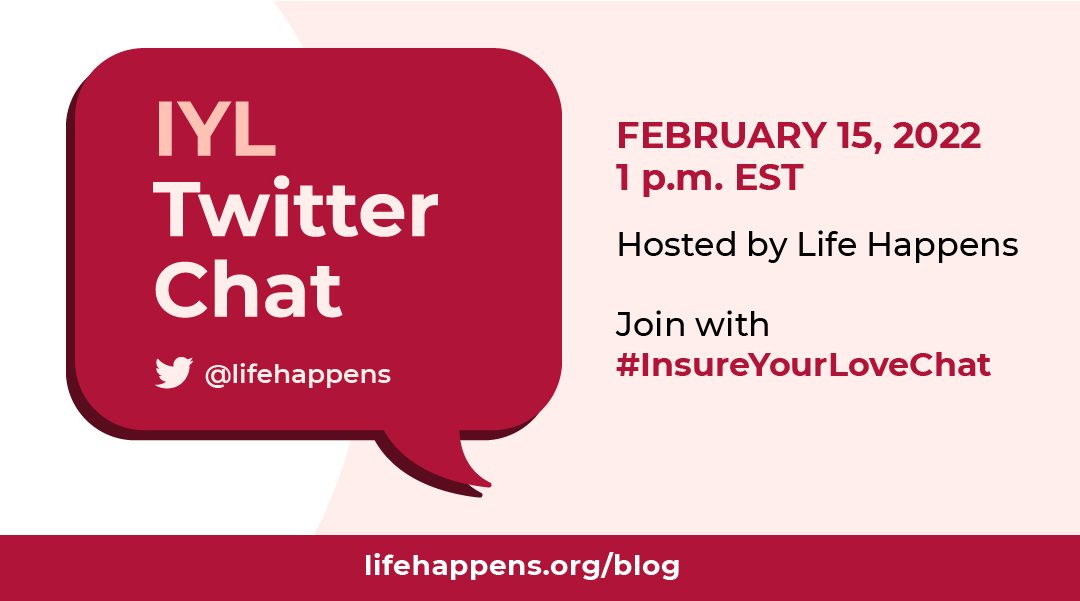

Join Life Happens for a Twitter Chat during Insure Your Love month this February. We’ll discuss new data from our latest study, “For Love and Money,” that analyzes the way people express or receive love and how that changes finances and financial conversations in ...

If your children are grown, the house is paid for and you’re about to retire (or already have!), it may seem like your time for life insurance has passed. Perhaps you feel that your savings and investments, along with Social Security, will take care of whatever ...

More Posts

The summer lemonade stand is a rite of passage for all kids. It is usually the first time a child gets to create their own business. They learn about the hard work it involves but also learn of its rewards, monetary and other. For my two girls, it was a lemonade ...

After feeling a lump in her breast earlier this year, my wife, Julie, who’s 35, had a 3-D mammogram. The radiologist reviewed the results with her and scheduled a biopsy for the following week. That’s when we found out that she had high-grade ductal carcinoma in ...

Join Life Happens and NAIFA representatives on Thursday, September 26th from 1:00-2:00pm EDT as we moderate a Twitter Chat focused on findings from the 2019 Insurance Barometer Study. There will be plenty of activity from the media, insurance companies, agents and ...

If you are expecting a child and are considering life insurance, the first thing I have to say is—smart move! But if this is your first time looking for coverage, you may have questions. Here are some typical ones I’ve heard over the years:

1. What type of life ...

America is a charitable nation. More than two-thirds of Americans (69%) give to charity each year. That means you probably do too. But did you know that there are other ways to give to charities besides just writing a check or supporting a Go Fund Me campaign?

A ...

It’s tough to learn that the life insurance company you applied to will not be offering you coverage, especially if you were fully expecting a yes! You may fall into the “impaired risk market,” which means you have something in your background that makes you a ...

Preston Newby was a youth minister. He and his wife, Tara, were driving with their son to visit family—excited to announce a new baby on the way. In the keeping with the kind of person Preston was, he stopped to help at the scene of an accident. That’s when he was ...

First off, great job on buying life insurance! You took an important step by protecting the ones you love.

Every life insurance policy requires you to name a beneficiary. A life insurance beneficiary is typically the person or people who get the payout on your ...

Each year, Life Happens and LIMRA join forces to take consumers’ “financial pulse.” The 2019 Insurance Barometer Study continues to track Americans’ financial concerns as well as what types of insurance coverage they have or feel they need. We also explore some ...

Are you headed toward retirement or even in retirement and concerned about outliving your savings? Perhaps an income annuity will fit your needs. An annuity is a financial instrument that can offer a guaranteed lifetime income that you can’t outlive.

I've spent ...

From getting married to having a baby to starting a business, there are lots of reasons why you’d want to consider buying life insurance. But maybe something is holding you back from getting the coverage you know (or suspect) you need.

Here are nine of the biggest ...

It’s Insure Your Love month. And what does that mean? Everyone wants the best for their family, whether that’s a spouse, children, aging parents, really anyone you need to take care of. And the numbers back that up: 81% of Americans believe their family is their ...